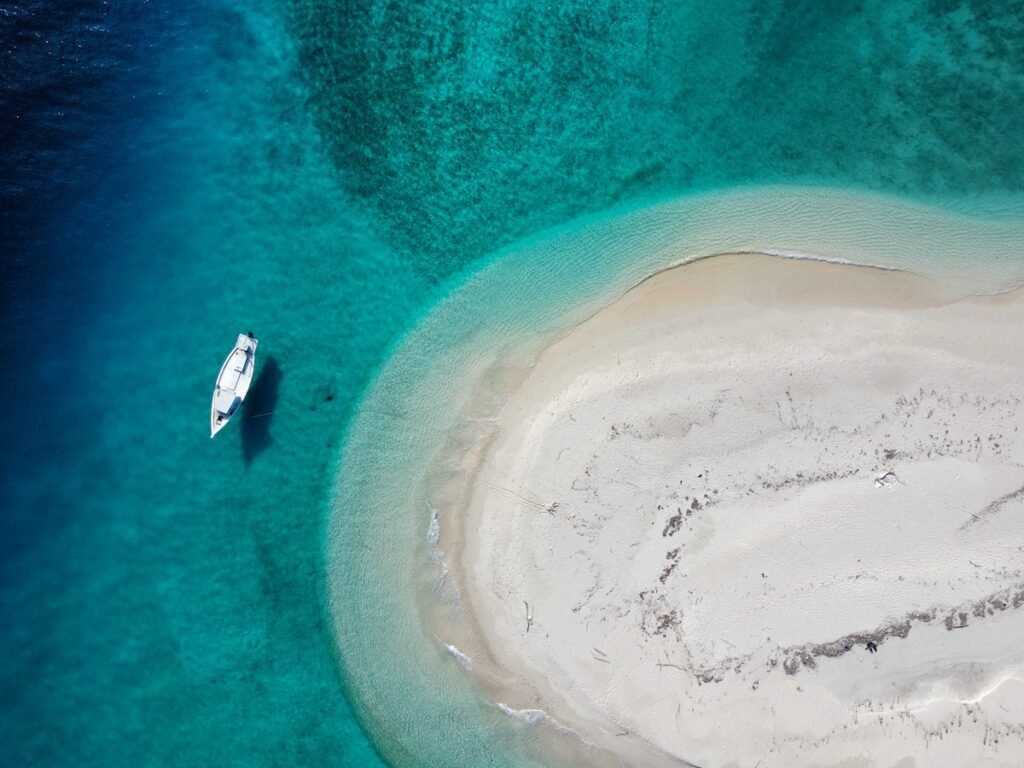

Buying an island is a dream that many aspire to fulfill.

The idea of owning your own private paradise, where the waves serenade you every morning and the sunsets paint the sky in hues of orange and pink, is undoubtedly enticing.

However, before you embark on your journey to buy an island, it’s essential to understand the intricacies of land ownership.

When buying an island, there are two terms that you’ll frequently encounter in this context are “freehold” and “leasehold.”

In this comprehensive guide, we will delve into the nuances of freehold and leasehold titles when buying an island.

We’ll explore the advantages, disadvantages, and crucial considerations for prospective island buyers.

By the end of this article, you’ll be well-equipped to make an informed decision and turn your island dreams into reality.

1. Understanding Freehold Ownership

What Is Freehold Ownership?

Freehold ownership, often referred to simply as “freehold,” represents the highest form of property ownership.

When you own a freehold property, you possess full and absolute ownership rights to the land and any structures on it.

This means you have the freedom to use, develop, and sell the property as you see fit, within the bounds of local regulations.

Advantages of Freehold Ownership

1. Absolute Control: With a freehold title, you have complete control over your island. You can build, renovate, or landscape your property according to your preferences, without needing approval from a landlord.

2. Long-Term Investment: Freehold ownership provides the opportunity for long-term investment and wealth accumulation, as the value of the property may appreciate over time.

3. Peace of Mind: There’s a sense of security and peace of mind that comes with knowing you have full ownership rights to your island, with no lease expiration date looming.

Considerations for Freehold Ownership

1. Cost: While freehold ownership offers numerous benefits, it typically comes at a higher initial cost compared to leasehold options. Prospective island buyers should be prepared for a substantial upfront investment.

2. Maintenance and Responsibility: As the sole owner, you are responsible for all maintenance and upkeep costs. This includes infrastructure, utilities, and any environmental preservation efforts.

3. Legal Compliance: Ensure that you are well-versed in local laws and regulations governing land ownership on islands, as these can vary significantly from one location to another.

2. Leasehold Ownership – A Different Perspective

What Is Leasehold Ownership?

Leasehold ownership, in contrast to freehold, grants you ownership rights for a predetermined period, typically ranging from a few years to several decades.

During this time, you have the right to use and occupy the land and any structures, but you do not have full ownership.

Advantages of Leasehold Ownership

1. Lower Initial Costs: Leasehold properties often have lower upfront costs compared to freehold options, making them more accessible for many buyers.

2. Lower Maintenance Responsibilities: Depending on the terms of the lease, maintenance and infrastructure costs may be shared with the landlord, making it more manageable for the lessee.

3. Short-Term Commitment: Leasehold ownership can be attractive for those who do not want a long-term commitment or wish to explore the island lifestyle before making a significant investment.

Considerations for Leasehold Ownership

1. Lease Terms: Be sure to thoroughly understand the terms of the lease, including its duration, renewal options, and any restrictions on land use.

2. Lease Renewal: Consider the implications of lease renewal or expiration. A leasehold property may revert to the owner (landlord) after the lease term ends.

3. Restrictions: Leasehold properties may come with restrictions on development, land use, and resale. Ensure you are comfortable with these limitations before proceeding.

3. Key Differences and How They Affect Island Buyers

Location Matters

When it comes to freehold and leasehold properties on islands, the location can significantly influence your decision.

In some regions, freehold ownership may be the standard, while in others, leasehold properties might prevail.

It’s essential to consider your preferred island destination and understand the prevalent land ownership regulations in that area.

Investment and Financing

Financing options may differ for freehold and leasehold properties.

Traditional lenders may be more willing to provide financing for freehold properties, given the higher level of security and ownership.

On the other hand, leasehold properties may require alternative financing methods or larger down payments due to their shorter-term nature.

Resale and Appreciation

The potential for property appreciation and resale value can vary between freehold and leasehold properties.

Freehold properties generally have a better long-term appreciation potential, as they offer the benefits of full ownership.

Leasehold properties, while often more affordable initially, may not experience the same level of appreciation.

Flexibility and Lifestyle

Your personal preferences and lifestyle goals will play a crucial role in your decision.

If you prioritize flexibility and short-term commitments, a leasehold property might be more suitable.

However, if you desire complete control over your island retreat and are looking for a long-term investment, freehold ownership is likely the better choice.

4. Legal and Regulatory Considerations

Due Diligence When Buying an Island

Before finalizing your island purchase, conducting thorough due diligence is essential.

This includes verifying the legal status of the property, understanding local land ownership laws, and assessing any environmental regulations that may impact your plans.

Legal Assistance

Given the complex legal nature of island real estate transactions, it is advisable to seek legal counsel experienced in the specific region where you plan to buy.

An attorney can help navigate the intricacies of land ownership, contracts, and local regulations, ensuring a smooth and secure transaction.

Environmental Impact

Islands often come with unique environmental considerations.

Preservation and conservation laws may apply to protect fragile ecosystems.

It’s crucial to understand how these regulations might affect your development plans and any potential environmental responsibilities.

5. Financial Planning for Island Ownership

The Initial Investment:

Freehold Perspective: Imagine the island as a blank canvas waiting for your artistic touch. Freehold ownership, while entailing a higher initial cost, bestows absolute control. Your financial canvas is wide open, allowing for personalized development, landscaping, and building without the need for external approvals.

Leasehold Perspective: For those eyeing a more accessible entry into island ownership, leasehold properties offer a lower upfront investment. This can be appealing, especially if you’re considering a short-term commitment or wish to test the waters before diving into a more substantial financial investment.

Long-Term Considerations:

Freehold Perspective: With freehold ownership, you’re planting roots for the long term. The potential for wealth accumulation arises as your property appreciates over time. However, this permanence comes with sole responsibility for all maintenance costs – a factor to consider in your financial strategy.

Leasehold Perspective: Leasehold arrangements, while presenting a more manageable upfront financial commitment, necessitate careful consideration of lease terms and potential renewal implications. Understanding the financial obligations during and after the lease period is crucial for sound financial planning.

Beyond the Purchase:

Both Perspectives: Financial planning for island ownership extends far beyond the purchase price. Property taxes, ongoing maintenance, and unforeseen expenses should all find a place in your financial roadmap. Balancing the allure of island life with the practicalities of financial responsibility is essential for a sustainable and stress-free ownership experience.

Building Your Financial Toolkit:

Freehold Perspective: As a freehold owner, traditional financing avenues may be more readily available, given the perceived security of absolute ownership. Crafting a detailed financial plan that includes long-term investment considerations becomes imperative.

Leasehold Perspective: Leasehold owners might need to explore alternative financing methods or be prepared for larger down payments, reflecting the shorter-term nature of their ownership. A robust financial toolkit should include contingencies for potential changes in lease terms and renewal conditions.

6. Making Your Decision

Weighing the Pros and Cons

Ultimately, the choice between freehold and leasehold ownership when buying an island comes down to your individual goals, financial situation, and lifestyle preferences.

Consider the following factors when making your decision:

1. Budget: How much are you willing and able to invest upfront? Freehold properties typically require a more significant initial investment.

2. Long-Term Goals: Are you looking for a long-term investment with potential for appreciation, or do you prefer flexibility and shorter commitments?

3. Location: Where do you envision your island paradise, and what are the prevalent land ownership regulations in that area?

4. Legal Considerations: Have you thoroughly researched the legal and regulatory aspects of island ownership in your chosen destination?

5. Lifestyle: Does your ideal island lifestyle align more with the freedom of freehold ownership or the lower initial costs of leasehold?

Conclusion

Buying an island is a dream that can become a reality with the right knowledge and considerations.

Understanding the difference between freehold and leasehold ownership is a crucial step in the process.

While freehold ownership offers unparalleled control and long-term potential, leasehold options provide flexibility and affordability.

Your decision should align with your budget, goals, and the unique characteristics of your chosen island destination.

No matter which path you choose, conducting thorough research, seeking legal counsel, and considering your lifestyle preferences will ensure that your island purchase is a step toward your ultimate paradise.

FAQ’s About Freehold vs Leasehold When Buying an Island

What does freehold mean when buying an island?

When buying an island with freehold ownership, it means you have complete and indefinite ownership of both the land and any structures on it.

Essentially, you own the property outright, providing a sense of security and control.

What does leasehold mean when buying an island?

Leasehold ownership involves buying the right to use and occupy the island for a specified period, typically through a lease agreement with the landowner.

However, you don’t own the land outright, and once the lease term expires, ownership reverts to the landowner unless a renewal is negotiated.

What are the advantages of freehold when buying an island?

- Absolute Ownership: Freehold ownership grants you full control and possession, allowing you to make decisions without external influence.

- Long-Term Investment: It’s a lasting investment that can be passed on to future generations, providing a sense of legacy.

- Flexibility: You have the freedom to develop, modify, or sell the property without constraints imposed by lease terms.

What are the disadvantages of freehold when buying an island?

- Higher Initial Cost: Acquiring freehold ownership often involves a higher upfront cost compared to leasehold arrangements.

- Responsibility for Maintenance: As the sole owner, you’re solely responsible for all maintenance costs and property management.

- Market Volatility: The value of your freehold property may be subject to fluctuations in the real estate market.

What are the advantages of leasehold when buying an island?

- Lower Initial Cost: Leasehold arrangements usually require a smaller upfront investment, making it more accessible for buyers.

- Predictable Costs: Leasehold agreements often outline predictable costs for the duration of the lease, providing financial stability.

- Reduced Responsibility: Some maintenance responsibilities and costs may be shifted to the landowner, depending on the terms of the lease.

What are the disadvantages of leasehold when buying an island?

- Limited Control: Leasehold owners have restrictions on property use, modifications, and may require the landowner’s approval for certain activities.

- Uncertain Renewal: The future of the property is dependent on lease renewal negotiations, introducing an element of uncertainty.

- Limited Investment Returns: The resale value of a leasehold property may not appreciate as much as a freehold property, potentially affecting long-term investment returns.